Most first home buyers in New Zealand will access their KiwiSaver to help fund your house deposit.

But is saving in your KiwiSaver the best option for you?

We look at the pro’s and con’s of using KiwiSaver as your main form of saving for a deposit on your first home.

KiwiSaver Helps Many Kiwi’s

First we need to look at what KiwiSaver does well.

One of the main advantages of KiwiSaver is that a high percentage of Kiwis have decided that they should be involved and therefore more people have larger savings than what they used to have.

Once people get started with contributions then they get used to not having that money, so in most cases people continue to contribute whereas they would have previously either stopped or raided their savings accounts.

When KiwiSaver was first established in 2007, there were a number of rules put in place to ensure that people would have the confidence to invest.

There are also some great benefits or incentives with KiwiSaver too;

- For employees your employer will match your contributions for up to 3% and this is compulsory if you are over 18-years old.

- The Government contribute up to $521.43 annually provided that you have contributed $1,042.86 for the period 1st July to 30th June and again if you are over 18-years old.

- Up until 21st May 2015 the Government offers a “kick start” which was a sum of $1,000 that was invested into your account on signing up. You cannot withdraw this original amount for a first home, but you get the advantage of anything that the fund has earned.

Over recent years many of the funds have performed well too and that has helped with your house deposit.

One of the major problems with using KiwiSaver is that most people set the contributions to the minimum of 3% and while they may have plans to increase the contributions and may increase them to ‘say’ 4%, people tend not to push themselves to save more.

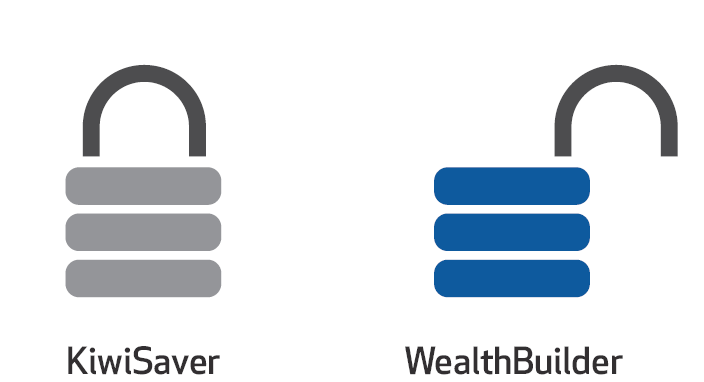

If only there was another fund that operated in a similar way to KiwiSaver, but had more flexibility around what you can contribute and also allowed access to the money when needed.

If you want to build your house deposit faster then you should consider a fund that is not locked in like Wealthbuilder.

The Advantage Of Unlocked Investment Funds

We know that for many of us having your savings within your KIwiSaver is great as we are unable to access the money for anything apart from our first home or retirement and of course the hardship exclusions.

But when you are saving to buy your first home you will also want access to money for the expenses that you may have such as valuations, building reports and solicitors costs. Of course it is always great to have extra money to help fund the deposit too.

One of the other advantages of having an unlocked fund is you can put in the maximum contributions knowing that you can access the fund for emergencies or if you have just over done your savings.

Review Your Savings Strategy Today

You need to do what is best for you.

In most cases if you are serious about getting your first home then you need to consider your KiwiSaver and also having an unlocked investment fund.

NZ Funds offer both KiwiSaver and the “twin” they call Wealthbuilder which gives you access to all the great features, options and low fees that the KiwiSaver have, but without the restrictions of being locked in.

Enter your details to receive more info:

It’s Another Step Towards Getting Your Home

Of course the ultimate goal is to get your first home, and having a deposit is one of the key things that holds people back.

We have created the online course called the Pathway to Home Ownership and this shares a wealth of information to help you get on track to getting into your own home sooner.

Recent Comments