It’s been a long time since we’ve had to be concerns about inflation.

In the past it’s been caused by people spending too much, which typically means the economy is booming. Normally that means wages have increased and keep pace with the price increases so people are not normally too concerned.

Back in the 1970’s and 1980’s we had inflation running at 10% – 15% and then a key driver of high inflation in New Zealand over this period was identified as being high government spending and a generally loose monetary policy.

In this article I’ve given a bit of a background, made some suggestions of how people (you) may be able to lessen the impact of higher interest rates and inflation and I’ve given my view of what we may see moving forward.

I’ve also included a podcast which you might find interesting or easier.

Please feel free to share this so others are informed too.

Understand The Reserve Banks Inflation Targets

Since September 2002, the New Zealand inflation target has been to keep inflation within a range of a 1% to 3% on average over the medium term.

The Reserve Bank has a role to keep the economy within those targets, and the official cash rate (OCR) is the main tool that the Reserve Bank has to control inflation.

The recent problem has been inflation was too low, so the Reserve Bank lowered the interest rates (OCR) to stimulate spending. They moved the OCR to the lowest ever in New Zealand’s history and injected cash into the economy by buying bonds. The result was they stimulated the economy to get through the COVID period.

Now, we’ve seen inflation spike to 5.9% (December quarter by Stats NZ) and it’s showing no sign of declining anytime soon.

So let’s have a look at what caused this.

Government spending of borrowed (spending money which they have not earned) has been a big contributor. Effectively it’s like a person putting the money on the credit card. You can feel wealthy at the time, but at some point in the future, you need to start repaying it… you face the consequences.

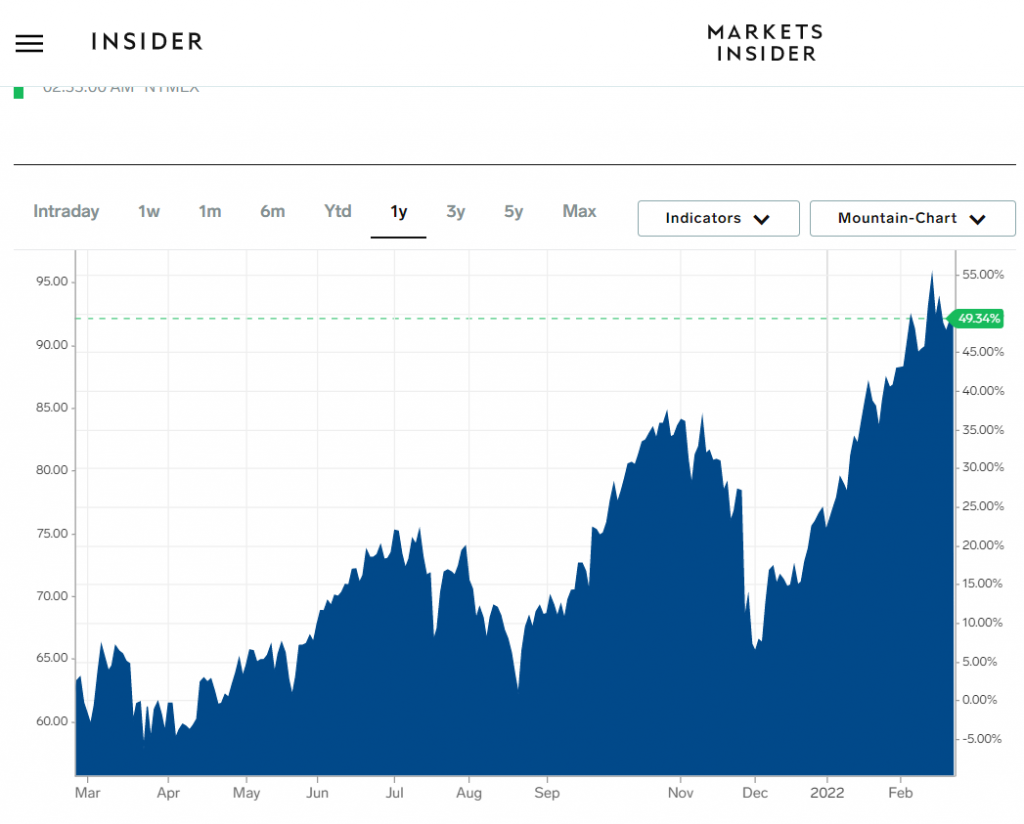

Offshore we’ve seen skyrocketing oil prices. Oil is a major component with many products that we use and influences prices of many products that use plastics, where oil is used in manufacture, in electrical generation and of course in transportation which directly affects New Zealand’s imported products.

There are also the Global supply chain shortages we have seen and heard about and we’re not just talking about the toilet paper issues! There are a lot of products that are short of supply and shipping issues around the world have meant that we can’t get the supply to the right places.

In New Zealand, we’ve also seen the Government put through benefit increases. While this is not necessarily a bad thing socially, it is injecting more money into the economy that has not been earned.

Some sectors of the economy are doing well, but many are not. So at the moment we have a new situation, a situation where inflation has skyrocketed from causes not linked to having a great economy. That’s new territory and the Reserve Bank are compelled to take action and the only tool that they have is to increase the OCR.

The Impact On Different Borrowers

As a mortgage advisor, I will look at how higher interest rates will affect homeowners and potential first home buyers.

Firstly, if we look at existing homeowners most are protected to some degree as they will have the bulk of the lending on fixed rates. They will eventually be impacted by higher rates but these increases won’t affect them immediately as they will have their loans fixed for one year, two years and often even longer like five years.

Property investors in most cases they will have their loans fixed the longer terms. Many prefer to have a longer term fixed rates that gives them certainty for planning, and this means many will not be affected immediately. It could be four or five years before they are impacted by the higher interest rates but what they will do in the meantime is look at the rents that they are charging and potentially increase those lesten the impact of those higher interest rates when they arrive.

For first homebuyers I am thinking there could both be positives and negative impacts. On the positive side we could see house prices increases start to slow or we may even see house prices fall in some areas. More importantly this may take some of the heat out of the market with less demand, and I would expect that this may see less houses being marketed and sold at auctions which are difficult and frustrating for buyers and especially first time buyers.

Then there are the negatives to consider. Of course, the obvious is that higher interest rates mean the mortgage repayments will be higher and that also means the banks will be tougher at giving mortgage approvals. With inflation everybody’s living costs also increase so that makes it even harder to live and save and then we could mention that the rents will no doubt be increased as well which makes it even harder to save that deposit for your first home.

Higher inflation and interest rates will affect almost all property owners.

Where does the blame lie?

As humans we are always looking to place the blame on somebody but it will not change the situation we’re in today.

Much of the cause has been drawn from overseas and things outside of New Zealand’s control, but not all of it.

As mentioned, we know that it’s also been fueled by unprecedented government spending and earlier when the Reserve Bank’s was focused on stimulating the market and it may well be that history may place a lot of the blame here. What we all do need to remember is that they were trying to do the right thing.

So What Can We Do As Individuals?

Individually we cannot do much about inflation except focus on our own spending and try to increase our own incomes. Both of these are possible, but maybe not always easy.

Reviewing Our Debt – some of our spending may be on debts that we already have, so we should consider if there’s a better way to manage these debts. As an advisor, I often see people with excessive debts and/or expensive debts and while they may have been easy to get they are harder to get rid of. The lenders didn’t do them any favors.

Some store cards like a GEM Visa will charge interest rates of 25.99% and many personal loans even with your bank are being charged at18.00%. If you look at your credit cards don’t be surprised to see interest rates close to 20.00% and that’s on top of the fees they charge you for the privilege of having the card.

We often refinance these into lower cost loans saving people a substantial amount, but getting this right also means that they can pay the loans off a lot quicker and free up the cash.

We would invite you to have a look at what lines you have and contact us to discuss your options.

Our Everyday Spending – you should also look at your everyday spending and see where you can make some changes.

A good tool that we recommend as Pocketsmith. It’s a software tool where you can easily upload your bank statements to analyse your spending. I’ve personally done this and been quite amazed at what we’re spending money on and the wastage that needed to and has bow been changed.

Don’t try to change everything at once, but instead identify the easiest things to change and focus on one area first. Use the software to see how your spending patterns have changed as you cannot hide from actual spending … Pocketsmith will help keep you honest.

Our Income – now I also mentioned income is something that you can change and a lot of people questioned me on this.

Of course in some jobs, if the business is going well you may be able to increase your income and if you’re self employed there are always opportunities to increase your income too; however there are also many people who believe that they cannot increase their income.

Of course this may be true in some cases, but not many.

The one thing I’ve learned over the years is that everybody has some spare time and if you’re dedicated to making change there are opportunities available for you to do so. I see a lot of people that have part time jobs, who may do extra work at there main job or have set up a small home business. I’ve seen people selling on Trade Me and making some extra money and I’ve seen people driving Uber. There are a lot of part time jobs available whether that be cleaning babysitting, mowing lawns, or pumping gas.

I don’t believe there’s any reason you can’t earn some extra money may make a huge difference if you are trying to buy a house or already have a mortgage.

My Two Cents Worth On Inflation & Interest Rates

So getting back to inflation and interest rates … they are connected but we cannot do much about them individually.

Instead, what we need to do is adapt our lives and finances to cope with the new environment of higher inflation and of course higher interest rates. Some of us that are a bit older have lived with higher interest rates like when I purchased my first home in 1990 and was paying 14.70% for my mortgage, but still managed to pay the mortgage and eat.

Over the years we have seen home loan rates decrease to record lows, and now they are just starting to increase a bit. The problem or scary thing today is that a lot of younger people and recent first home buyers have a much larger mortgage and so every increase is going to make a difference.

As a mortgage adviser I get asked if higher interest rates may remain with us for a long time? That’s really a question that we don’t have the answers for yet; however I do believe that if the economy does not start recovering soon we could easily see a recessionary environment and that will force The Reserve Bank to stimulate the economy once again by lowering the interest rates.

If only we had a crystal ball!