Many people will ask family and advisers if they should buy a house now or save a bigger deposit.

This is a question that all first home buyers ask, and not just in New Zealand.

In 2020 when COVID hit there were a number of economists that were predicting house prices to fall in which case waiting was seen as a good option especially as it would allow you to save a bigger deposit while house prices were not expected to rise. If anything first home buyers were nervous that they may lose money if they purchased too soon.

Waiting was seen as the best option, or at least until it was confirmed that COVID was not going to cause the housing market to crash or even stall.

Banks Targeting 20% Deposits For Home Loans

The banks are all giving preference to those people with a 20% deposit, but they will still offer people home loans with less than this.

If you have a minimum of 20% deposit then you are offered the best home loan interest rates and most banks are providing cash incentives too. If you have less than 20% deposit then you will be charged higher interest rates which most banks refer to as a low equity premium or low equity margin. The banks also offer less as a cash incentive and in some cases none at all.

For these reasons many first home buyers think it will be better to wait until they can save a larger deposit and therefore get the better rates.

This can be a good idea in a flat or declining market, but in a rising housing market it is often better to accept the higher costs and buy a house now.

Factor In The Housing Market

If you are considering saving a bigger deposit before buying then you should factor in what has been happening to the New Zealand housing market, then consider what you think may happen in the future too.

We know that history is not necessarily going to predict future house prices, but you should always consider what has happened as it can help you decide what to do.

The Real Estate Institute of New Zealand (REINZ) has some useful data that shows house price movements.

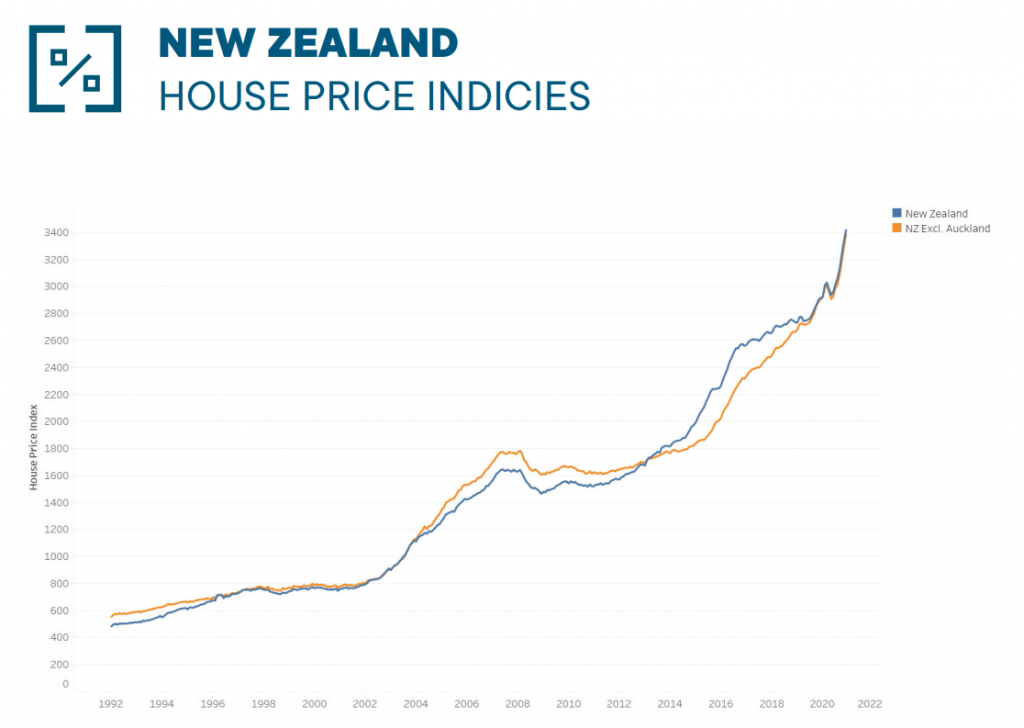

As you can see in this graph (below) the house prices have risen significantly over the years and apart from the Global Financial Crisis and few preceding years the market has tended to rise, and at times very sharply.

So the real question is do you belief that the housing market will continue to rise?

How Much Deposit Do You Have?

One of the major factors will of course be how much deposit you have.

The banks preference is that you have a minimum of 20% of the purchase price for the new home, and it the larger towns and cities that can mean you require quite a large depsoit.

If you have less than 20% it doesn’t mean that you cannot buy your first home, it means the bank will be harder on your mortgage application and will also not offer the same interest rates and cash incentives.

Banks tend to scale the low equity margin or premium depending on the deposit. This can often mean paying an extra 0.75% if you only have 10% deposit but 0.20% – 0.30% if you have a 15% deposit.

The non bank lenders also scale the interest rates charged and offer some good options that may allow you to get into your first home with lower deposits as they can combine with a second mortgage to help get the required amount.

Another option that has been available overseas and is becoming more popular in New Zealand is co-ownership. This allows you to purchase a home with as little as 5% deposit, generally funding up to 80% (sometimes more) with a non bank lender and then having a company take some equity to make up the difference. There are some pro’s and con’s to this option, but it allows you to get on the property ladder now where otherwise you may end up waiting and watching house prices increase. We have written about buying a home with co-ownership in our blog here and also it is discussed as an option in the Pathways to Home Ownership course offered.

The Real Cost Of Waiting To Buy Your First Home

The real cost waiting is generally discussed as being the house price increase.

You may have be looking to buy a home for $650,000 12-months ago, and using the average increase over the last year that house would have increased by approx. $110,000 (17.3%). Of course if you have ‘say’ 10% a year ago you would have had $65,000, but to buy the same house now you would be paying $760,000 and so you would have needed to save an extra $11,000 ($76,000) just to still have a 10% deposit. To save a 20% deposit you would have needed to save an extra $87,000 over that 12-month period.

The other option would have been to accept that your mortgage was going to cost more in which case you would have purchased for $650,000 with a 10% deposit ($65,000) and therefore had a mortgage of $585,000. Even if you had to pay low equity margin of an extra 0.75% then the extra interest that you would pay would have been about $365 monthly or about $4500 over that 12-month timeframe. With the right bank (mortgage policy) you could have had the low equity premium removed during the year when your property had increased by 10% and therefore got the lower discounted mortgage rates.

Still Paying Rent

While you are saving you are still paying rent.

Once you purchase the money that you were paying as rent will go to paying the interest to the bank.

Both rent and interest can be described as a cost.

Rent is a cost that you have no control over, and it will generally continue to increase over time.

You do have some control over the interest that you pay, and over time as you pay off your mortgage the interest cost goes down until eventually your mortgage is paid off and there is no more interest to pay.

Owning your own home does give you more control over your money, even if the mortgage feels quite daunting to begin with.

Recent Comments