For many first home buyers getting approved seems like a win, and it sort of is BUT maybe it’s not as good as it could be.

When we look at the reality of being a first home buyer it’s the home that you want, and the mortgage that you need. When a bank approves your mortgage application then you will just be thankful that you can get your first home.

You’re probably not that focused on the mortgage – after all it’s approved.

Isn’t that the main thing!

Well that’s exactly how I felt when I purchased my first home – I spoke to a lady at Postbank (which is now ANZ) and she approved my mortgage and I was just like WOW … thank you.

That’s until the grind of paying off the mortgage started, and later the realisation that I’d had no advice on how to structure the loans and actually just had one loan, locked in for 3-years at what became a high interest rate and no flexibility.

Of course that was before I knew much about mortgages and finance.

Let me explain what I mean.

We See Hundreds Of Mistakes

I’ve been a mortgage adviser for over 20-years and set up the Kiwi First Home Buyers Group on Facebook over 10-years ago.

On the group, I have spoken to hundreds of first time buyers and seen comments from thousands, and there’s a very familiar theme that the desire is really to get the mortgage and then questions often get asked later.

Almost every day you’ll see somebody asking about interest rates, about loan structures. And every other day, we will have people contact us that have had a mortgage for a period of time and when we review it, we can see some obvious mistakes all of the banks claim to offer home loans for first time buyers and they do offer those loans.

But those loans are not all the same.

The thing is with most first home buyers, they are entering the market with a lower deposit then the banks deem as being ideal. That is many of them have less than 20% for the deposit. The banks penalise those people with less than 20%, or another way of looking at it is they focus and give special deals to people that do have 20% or more. That’s a general rule with banks.

Some banks will come out with deals specific to first time buyers, and they will be giving you lower interest rates often and for a short period of time.

But that lower interest rate really, really helps when you’re getting started.

Steve Was Approved BUT…

I spoke to Steve this week and he was offered a special rate of 6.99% for 1-year (standard rate 7.59%) and was wondering if he was doing the right thing. He had been dealing direct with the bank which he described as “his bank” or in other words the bank that he has banked with for a number of years.

Obviously, Steve was just so grateful to be approved by his bank and was now just considering what interest rate to select – if he should go with the 1-year rate offered.

When I mentioned that he could have got 5.99% with another bank he was a bit annoyed with what he had been offered – but at least he found out before he was committed.

In many ways you could argue that the bank did look after Steve because they approved the mortgage. But I would argue that the bank were really not looking after the first time buyer (Steve) but they were looking after the bank and the shareholders. What I mean is the bank are a business and were focused on how much profit they can earn.

If Steve had gone ahead with the special rates his bank offered he would have paid 1.00% more, and on his mortgage of about $600,000 that would mean paying the bank $6,000 a year ($115 a week) more than he needed to. Paying his mortgage off over the 30-years his repayments would have been about $920 a week

Get The Right Loan & Right Structure

Once Steve understood the options a bit better we got his mortgage approved with another bank that was prepared to offer him the better interest rates, but also we worked on the loan structure and showed Steve how to manage the loan better.

We could have just given Steve the lower interest rates and let him pay the loan at $830 a week, and I’m sure Steve would have been happy with the savings! But instead what we did is structured the loan and showed Steve what happens if he pays the original $920 a week – the extra $90 a week he had expected to pay.

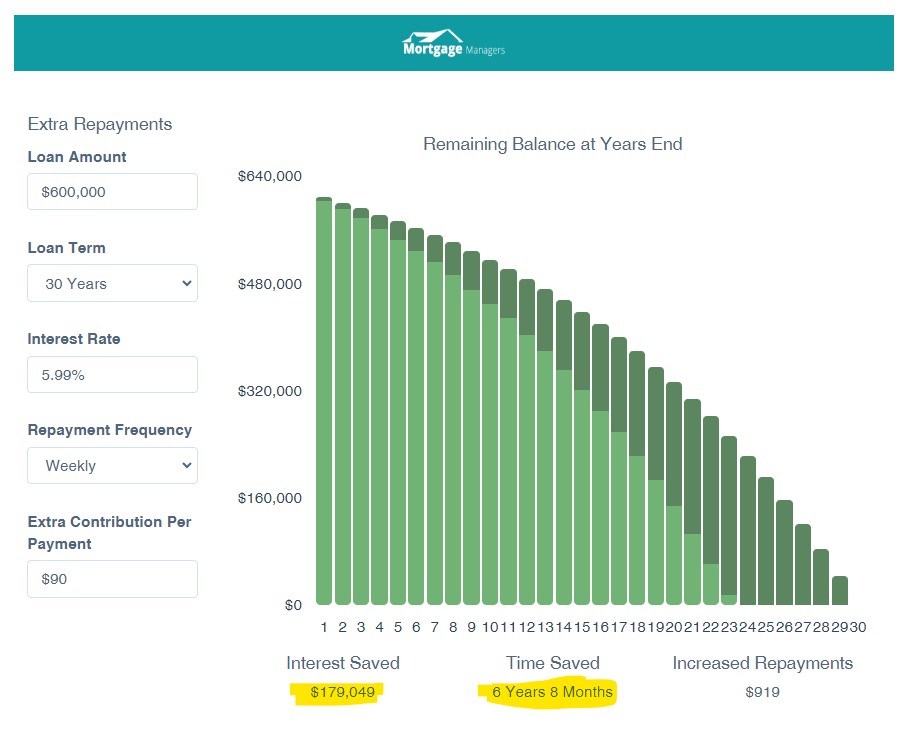

As illustrated below, by paying the extra $90 a week he could pay the mortgage off over 6-years sooner and save a massive $179,000.

To say that Steve was “blown away” was an understatement. He was starting to understand how he could save money and pay off his mortgage faster, and also was seeing where a mortgage adviser can be helpful – he previously thought that it was just about getting the mortgage approved.

Having a mortgage is a big commitment, and it’s worth getting the right advice so you do not waste money and end up paying more than you need to.

Are You Looking For Good Advice?

My name is Stuart Wills and as mentioned I have been a mortgage adviser for over 20-years.

I love helping first home buyers and making sure that they get their loan approved, but also making sure that the loan is with the right bank and set up properly. In my opinion getting the right loan and being shown how it works is more important and where the banks fail so many people.

Many first home buyers will already know about the Facebook Group that I set up as another way to make sure that first home buyers get advice. I am proud of what this group has become and how it’s helped so many people.

I have also built a team of mortgage advisers at our office, and we all work together with the same philosophy to help first home buyers.

If you are looking for a home loan, or just need advice on a home loan that you already have then can I suggest that you get in touch with one of the team to help – the advice is free and could save you a lot of money in the same way it has for Steve.

Recent Comments