In the past year we have certainty seen a big increase in people applying for the First Home Loans which is backed by Kainga Ora.

It’s become more popular as first home buyers have seen an opportunity to buy while the market is down, but rents are up. It’s made buying a really good alternative and this is an option that lets people buy now where otherwise they may have waited while they save a bigger deposit.

We, as mortgage advisers have seen this but also the statistics from Kainga Ora confirm this too.

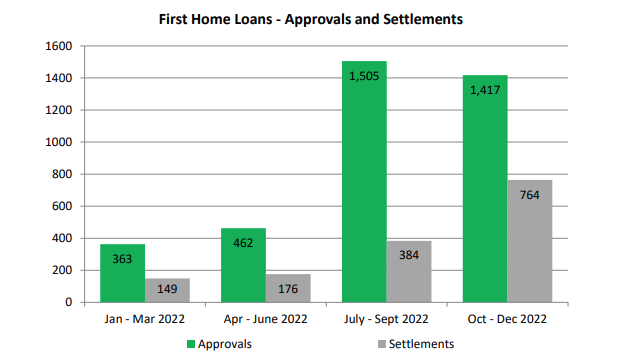

As you can see on the graph, the number of approvals has skyrocketed and the number of settlements has risen steadily too.

This is quite a large increase, especially when you consider most of the main banks do have access to the First Home Loans and of course therefore the banks staff know very little about this as an option.

What Is The First Home Loans?

First Home Loans was designed to help the many Kiwis that would love to get their own home, know they can afford the mortgage repayments but cannot save a big enough deposit and do not have the bank of mum and dad.

This works well because Kāinga Ora underwrites the loans offered by the banks and other lenders, allowing them to provide loans that would otherwise sit outside their lending criteria.

First Home Loans are issued by selected participating banks, lenders, building societies and credit unions and are underwritten by Kāinga Ora – Homes and Communities. Some banks and lenders have special deals they can offer and some may also allow you to build a new home with a First Home Loan.

First Home Loans allows you to buy your first home with as little as 5% deposit, and the deposit can be inclusive of all savings, your Kiwisaver withdrawal, the First Home Grants and also any gifts.

It’s a way to get a smarter start onto the property ladder.

There Is Strict Criteria You Must Meet

To be eligible for the First Home Loan you must meet strict criteria, so it’s not for everyone.

Below is an overview of the key requirements:

You must be a New Zealand citizen, permanent resident or resident visa holder who is ordinarily resident in New Zealand.

- You must be a first home buyer or previous homeowner (second chance applicant) in a similar financial position to a first home buyer. That means you cannot own any other property or land, except this does not include ownership of Māori land/.

- You must be purchasing a home for you to live in as your primary place of residence and it cannot be over 1 hectare.

Your Deposit

- You need to have a minimum deposit that is at least 5% of the purchase price of the home you are interested in buying (inclusive of all savings, grants, first-home withdrawals, and gifts)

Your Income

- $95,000 or less for an individual buyer without dependants; or

- $150,000 or less for an individual buyer with one or more dependants; or

- $150,000 or less (combined) for two or more buyers, regardless of the number of dependants

The House

Up until recently, the First Home Loan was only available for houses priced under strict regional price caps; however price caps have now been removed. So, with a First Home Loan, now it’s even easier to secure a loan for a home with a deposit of just 5%.

The Loan Application

Providing you meet the criteria above, then you still need to be approved by the bank or lender, plus Kāinga Ora for your home loan.

This means you must meet the lending requirements of a participating bank or lender for a home loan including having a good credit score, the ability to prove income and to afford your living costs, any existing financial commitments and the new home loan.

Kainga Ora also charge a 0.50% Lender’s Mortgage Insurance (LMI) premium and typically this is added to the loan.

A Limited Choice of Banks

One of the reasons that so few people know about the First Home Loans and how you can buy your home with as little as 5% deposit is that not all banks offer this option.

There are just four banks that offer this: Co-Operative Bank, Kiwibank, SBS Bank and Westpac.

They all have different criteria and there are some special packages for first home buyers at times too.

You want to know that you have a mortgage adviser that knows the different criteria and can ensure that you get the best package that is available, rather than just going with the easiest bank to get approved with.

Mortgage Managers – the Mortgage Advisers That Know First Home Loans

So you now know a bit more about First Home Loans.

This was designed to help Kiwis that would love to get their own home. It’s for people that know they can afford the mortgage repayments but cannot save a big enough deposit.

Maybe it’s what you need.

As mortgage advisers (brokers) the team at Mortgage Managers will work with the bank that suits you best to make sure that you have the best chance of getting your mortgage approved, and to ensure that you get the best loans available too.