When we heard from Shane we questioned if he could buy a home, but we thought we should consider all options for him and we’re glad that we did.

Shane was like many first home buyers – lacking the deposit that banks are asking for (20%) and being single was short on income for the banks too, but he was also motivated to buy a home and therefore deserves the extra effort that a mortgage adviser can give.

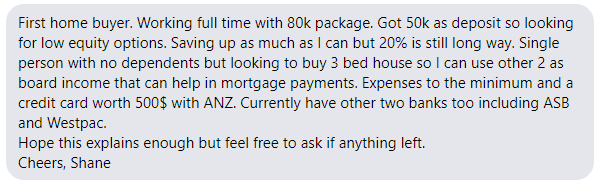

His initial enquiry was simple:

It’s great to see people like Shane that are motivated to buy his first home.

His Bank Said “NO”

We hear of a lot of people that approach the bank that they have accounts with thinking that this is the best way to get a home loan approved, and so often they are disappointed. They are disappointed with the answer (the “NO”) but if they really knew that the bank has such limited options they would probably be more accepting – banks will often say “NO” as thew “system” they use does not think outside the box.

Banks are very limited about what they can offer, and generally bank staff have no idea what options there are for first home buyers.

The staff at the banks are trained on that one banks products, and even that training is more about operatine the banks systems rather than understanding the banks might be able to do.

Mortgage Advisers Have More Options

Mortgage advisers enjoy having more options and that means having access to a number of banks and non-bank lenders too, but more importantly some of the better mortgage advisers are willing to consider all options available.

As a mortgage adviser for over 25-years, I am proud to say that I’ve never worked for a bank and therefore never been tainted with the bank’s way of thinking. Instead I have always looked at things from my customers (your) point of view and when I meet someone like Shane I understand that he is deteerimens to buy his own home and therefore will go the extra mile to ensure he knows all options including First Home Partners.

Shane had two limiting issues with his application – he had a lower deposit than the banks wanted, and he had a lower income that the banks wanted.

BUT … Shane wanted a first home and knew he could afford the repayments.

Shared Ownership Helps Shane Into His First Home

When Shane contacted me he had already spoken to his bank and was disappointed with what they said he could do. They had suggested that with his $50,000 deposit and income of $80,000 he would be able to borrow about $300,000 and that meant buying to a maximum of about $350,000 which is an impossible task in Auckland.

Shane thought be would need to spend $600,000 – $700,000 to buy a home in Auckland.

Rather than giving Shane another “NO” I looked at what he could afford and gave him some options to consider.

Shared home ownership is an alternative homeownership scheme where you purchase the major share of the home, but have another party owning the other share. It’s often used by first home buyers when they cannot but the house that suits on their own, maybe limited due to the deposit they have or the income that they earn. The other share may be a family member, the Government backed scheme or a commercial scheme.

Family can be a good way of doing some shared ownership if by way of a good and equitable agreement. Unfortunately too often these types of agreements with family are entered into on a very causal basis and end up in a family argument. Make sure that you invest in getting a good property sharing agreement in place at the beginning.

The Government backed scheme is called First Home Partners and is a very good shared home ownership scheme, but there is some strict criteria and it’s designed only for new builds. The other option is to use a commercial scheme which are more flexible but costs a bit more as they have to make a profit. The main scheme is YouOwn and this can be used to help purchase either a new build or an existing property.

After looking at the various banks and using an income from a flatmate we were able to get Shane an approval to borrow up to $560,000 from a bank. That was a lot more than his own bank were willing to offer, but with his deposit ($50,000) he was still not able to buy a home in Auckland.

However when we looked at the First Home Partners we could see that he would qualify and that meant this was another option for Shane.

In fact when buying a brand new home First Home Partners looked like a very attractive option!

Shane knew that he needed to spend close to $800,000 to buy a house that would suit.

First Home Partners allowed Shane to spend an extra $200,000 with the shared home option, and that meant he could buy a home for $810,000 instead of the $610,000 that the bank said wa sthe maximum.