When you apply for any loan the lender will look at your credit score and review your account conduct to determine if you are a good risk.

With short-term or smaller loans the lenders might charge higher interest rates and therefore be prepared to accept a higher risk, but when you are looking at getting a home loan the lenders will look at your bank account conduct more closely to see how good you are at managing money.

Part of the reason for this is due to the long-term nature of home loans – the lenders have to know that you will not fall into bad habits with money.

The lenders are more cautious and sometimes seem overly cautious.

You might hear them saying that they “care” about their customers, but their main focus is to look after the business to make money for the shareholders and that means making sure that they do not take too many risks where there is potential for the bank to lose money.

What The Lenders See

Bank account conduct has become an important consideration so it’s important to know what the lenders are looking at when they review your credit checks and bank statements.

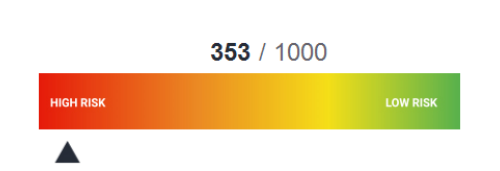

Credit Scores – when the lender does a credit check the first thing they will look at is the credit score. This is a rating that the credit agency provides based on a number of factors including payment history and defaults. Often people think that they should have okay credit as nothing has ever been highlighted with any form of collection; however they can be unaware that their credit check also records late payments.

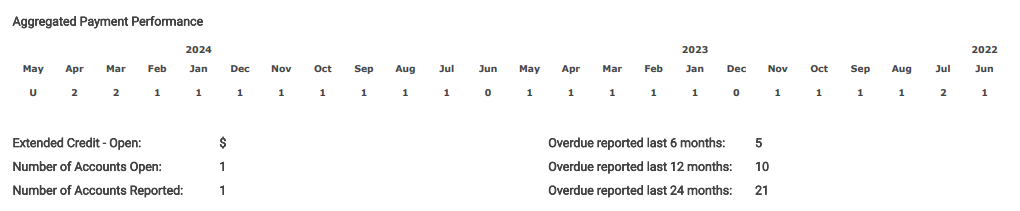

Late Payments – a number of banks, finance companies and utility companies supply the credit agencies with monthly reporting of payment arrears, and so even being a few days late can be recorded and can show on your credit report, and also negatively affects your credit score. Lenders not only look at your credit score, but they review the account payment history which goes back for 2-years. As above, these reports can show a persons payment performance across all of there accounts and gives the lender some good history. (this is particularly bad!)

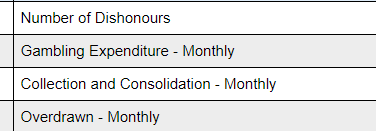

Responsible Lending Flags – when a lender reviews your bank statements they will look for the “flags” that are highlighted. The lender will request 3-months bank statement, or your existing bank can look further back. The software used will highlight if there are any payments dishonored, any gambling, any payments to collection companies and if there has been any unarranged overdrawn accounts

The lenders will normally view these summaries first, and then dig deeper if needed.

What You Need To Know About Bank Account Conduct

Firstly, it’s important to understand that you cannot change the past but also that this information is collected on everyone and made available to lenders when required.

The lenders will look at the key metrics as noted above, and then may also dig deeper to review individual transactions too.

If you are applying for lending at your existing bank then they can go back as far as they want to review your account conduct, but typically a new bank or lender will request 3-months bank statements to review, and as mentioned will see the last 2-years repayment history on your credit check, plus any defaults remain on there for 5-years regardless whether paid or unpaid.

Most of the best mortgage advisers will get your credit check and your bank statements to analysis before submitting to a bank. They will review them in a similar way to any lender, and therefore be able to address any issues with you and have them answered before anything is sent to the lender for assessing.

This has been proven to be the best way to get a successful outcome – highlight the issues with good notes etc rather than try to hide any issues in the hope that the lender will not find out about them. Lenders have access to a lot of data so it’s pretty hard to “hide” stuff.

Recent Comments