Every person is different, and yet the banks try to squeeze everyone in the same box.

Mortgage advisers will look at what makes your situation personal to you, and find a box that can be shaped to suit.

As the New Zealand lending market gets harder, people are choosing to use mortgage advisers before banks.

In the past people have often gone directly to “their” bank as they had a relationship there and felt that because of the history with that bank it was going to prove helpful when applying for a home loan; however over recent years those perceived bank relationships have been diluted as the banks continue to centralise and automate processes.

Your relationship or history with a bank is no longer the benefit that it once was, and sometimes it actually works against you.

People are learning just how difficult it is to walk into a bank and get a home loan approval.

Banks Can Make It So Hard To Get Approved

The lending landscape has changed and everyone is struggling to navigate the changes that are coming think and fast.

Banks are focused on centralising and automating processes and that is a cost saving to the bank, but it means if anything does not fit within the “normal” criteria then they have reduced options of making decisions that may help you.

These systems that the banks have introduced are meant to streamline the processes, including the mortgage approval process; however in many ways they do the opposite.

Credit Checks & Bank Statements

The systems will automatically get your credit check and bank statements and from these two bits of information they will make decisions about your lending.

Credit Checks – these now not only show the banks what your past credit history is, bit they show any open accounts that you have (including some that you may have thought were paid off and finished) and the repayment history for those accounts. You may have an electricity account, store card or credit card that is sometimes paid a few days late and they will see that You may have a buy now pay later account that was paid off, but unless it was subsequently cancelled it will show as still being a live account and this can mean the bank will factor in the deemed repayment as if it was being fully used. This is a risk with buy now pay later accounts that people are not even aware of.

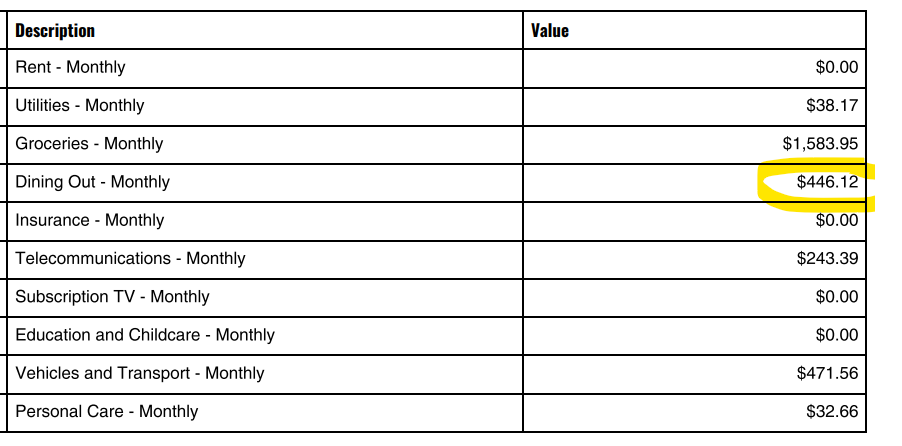

Bank Statements – most banks and lenders will want these to be provided via an automatic download as this is provided with your transactions all analysed giving a breakdown of your spending. They will then override what you may have provided as being your expenses with what the statements are telling them, and in many cases this is not a true reflection of your spending. You may have said that you spend an average of $200 a month on eating out, but then your statements (as below) say $446 and the banks will often take the new higher figure without asking for any explanation. It may have been that there was a one-off dinner (birthday or celebration) or it may have been that you paid for something and were reimbursed by others. These sometimes inflated expenses can often mean a loan is declined when it should be approved.

It’s important to automate things where efficiency can help, but there also needs to be some oversight and the ability to adjust things as required. Too often decisions are now made solely on data without oversight or common sense being applied.

Mortgage advisers should review applications and adjust where needed before sending to the banks for approval, and this approach has proven to increase the success of the applications.

Why Would You Go Directly To A Bank?

Mortgage advisers have options, so unlike a bank they can normally find an option that suits you.

Of course some people will still go directly to the banks for home loans, but the number are declining in New Zealand in the same way its happening in other countries. In Australia its reported that 70% of people are using mortgage advisers in preference to banks. The same data is not available in New Zealand but some banks have reported an increase in adviser generated business.

The ability for banks to service clients on a personal level has dwindled over the years and especially more recently where many say it no longer exists.

It’s Easy to use mortgage advisers

Mortgage advisers will take the time to understand you and your situation, then look at the various options that may suit.

It’s not about forcing you into a box that suits the bank, but instead they will work to find a box that can be shaped to suit you.

Advisers like the team at Mortgage Managers have embraced technology and that’s made it even easier to deal with them.

Recent Comments