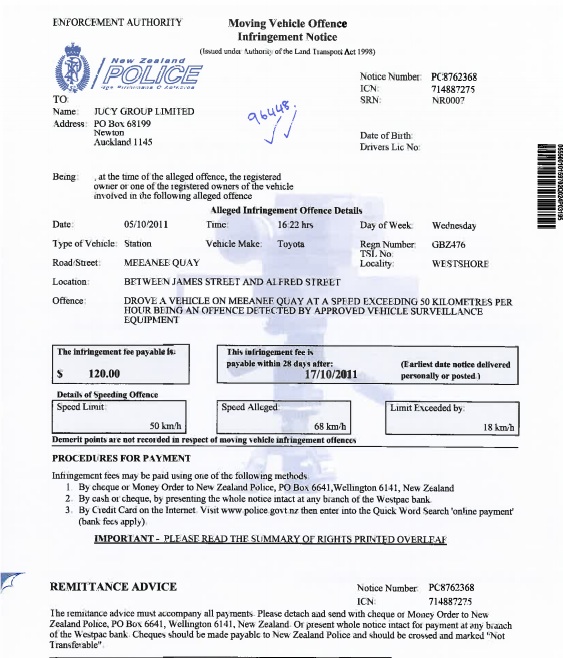

As mortgage advisers we often uncover unpaid fines and the applicants are surprised when we say you need to disclose unpaid fines.

After all an unpaid fine is a debt that you owe.

And often the reason an adviser will ask about unpaid fines is because they have either found out about them on your credit check or your payslips, and often both.

You Must Disclose All Debts

When you complete a finance application you are asked to disclose your liabilities …. your debts.

That includes any money owed, including and unpaid finds.

After all these are debts that you will need to pay.

Plus by not disclosing these debts you are highlighting to the lender that you may be trying to falsefy you real financial posoition.

Maybe that sounds a bit harsh … but some people do try to hide what they owe to make their finance application look better.

It’s Harder To “Hide” Debts Than You May Think!

Most good mortgage advisers will complete a credit check, and those that don’t will know that the banks will do the credit checks anyway.

These days the credit checks have a lot more information, and as advisers we now always request a check on fines too. This way we can see whatever the banks will see and can address the issue of any unpaid fines before the banks ask.

With your finance application an adviser will also require copies of your payslips and often fines are paid by wage deductions and therefore are obvious the minute the lender has a look at your payslips.

It’s hard to hide from your fines!

But Don’t Stress…

Yes, you need to disclose unpaid fines but generally the lenders will accept an explanation and especially if you have honored your repayment plan.

Loads of people get fines and sometimes they are not easy to pay off in full.

Of course, none of us really want fines but they happen.

Talk to your adviser if you have fines and get advice in regards to paying them off in full or continuing on your repayment plan.

Recent Comments